SIMPLE Invoice Processing Tool for Small Business

SIMPLE Invoice Processing Tool for Small Business https://echovera.ca/wp-content/themes/corpus/images/empty/thumbnail.jpg 150 150 Tim Robertson https://secure.gravatar.com/avatar/6847ba38495b3996e0bdf3a15c015e0c?s=96&d=mm&r=gFinally! A simple automated invoice processing tool for small business

There are times you want all those invoices streaming into your inbox or piling up on your desk to be transformed – no, not into dollar bills, although that would be nice – into pure data. In other words, just changed to a convenient CSV or XML file.

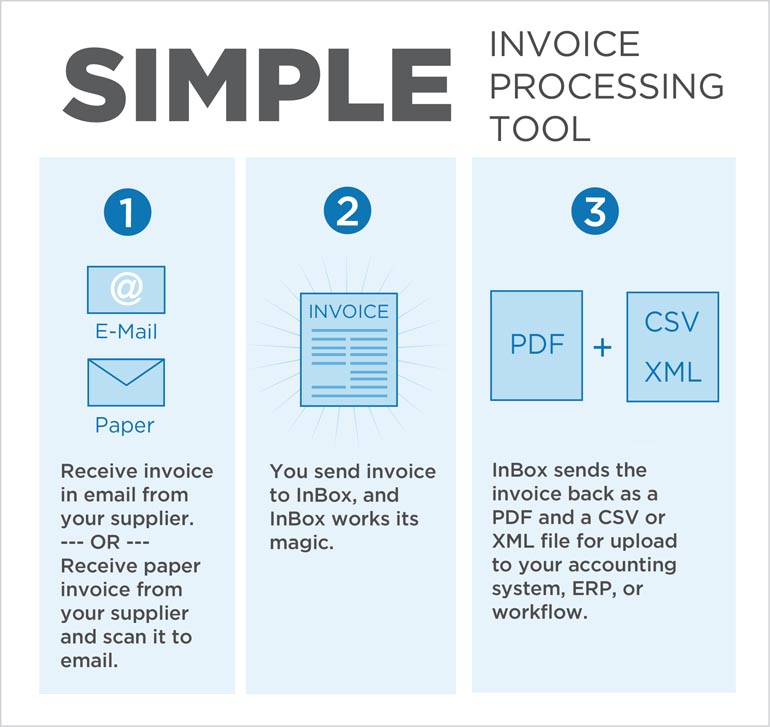

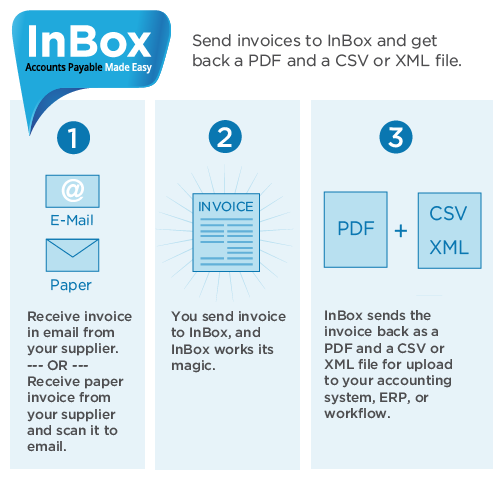

The way this is done is fairly simple. You send an invoice into a service like InBox, where it takes your paper invoice (that you have scanned) or an emailed invoice (which could be a PDF, Word, or other file) and sends you back an XML or CSV file. Done!

From there you can take the information and plug it into your accounting system or ERP. A great way to save time and money, but what we think is even better, stress and hassle!

Processing invoices ranks up there with sorting laundry, doing taxes, – its manual work that creates headaches with errors and mismatches.

The tool also gives back what is called a “data” PDF, which means it is a file format that can be read by electronic invoice systems.

This is what might be called AP automation, although because there is no fancy stuff like “workflow” and “audit trail”, it might be better just to call it a great invoice processing for small business.

AP automation software packages or SaaS platforms can sometimes be expensive to purchase, and there is usually some resistance to both the cost and the learning curve that comes with them. They come with features that may not be used, and might not be suitable for small business. You can see more about InBox here.

References:

What is electronic invoicing? (from Wikipedia)

Electronic Invoicing can be a very useful tool for the AP department. Electronic invoicing allows vendors to submit invoices over the internet and have those invoices automatically routed and processed. Because invoice arrival and presentation is almost immediate invoices are paid sooner; therefore, the amount of time and money it takes to process these invoices is greatly reduced. These applications are tied to databases which archive transaction information between trading partners. The invoices may be submitted in a number of ways, including EDI, CSV, or XML uploads.