PayStream Report: Invoice Approval Workflow Trends

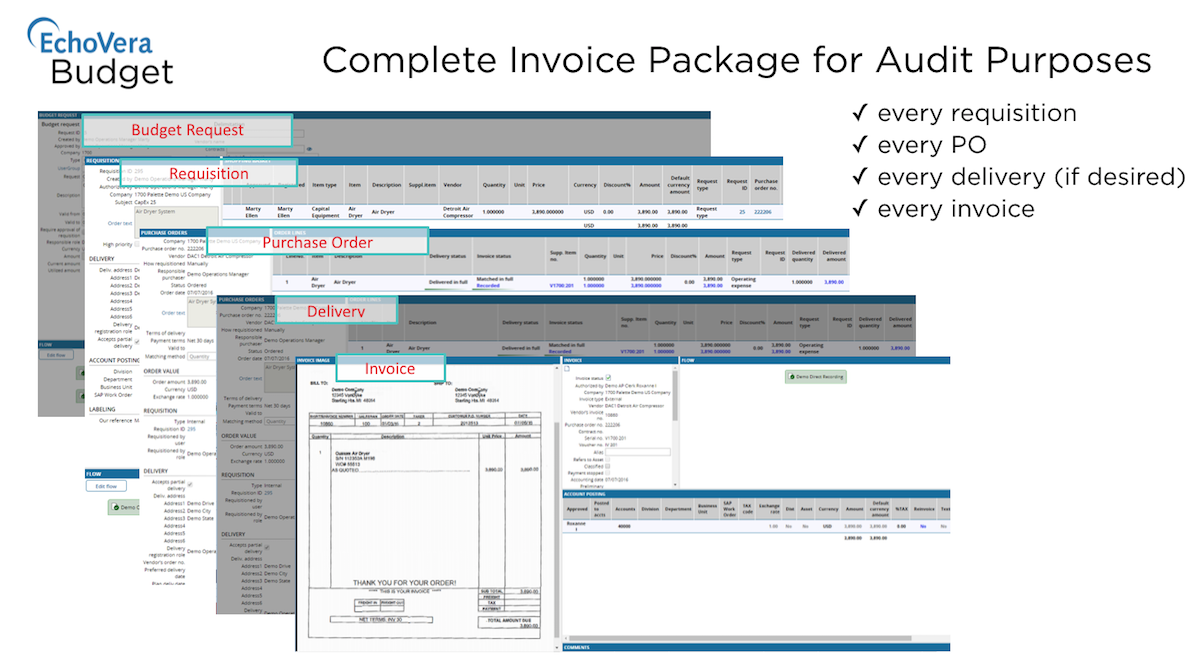

PayStream Report: Invoice Approval Workflow Trends https://echovera.ca/wp-content/themes/corpus/images/empty/thumbnail.jpg 150 150 Tim Robertson https://secure.gravatar.com/avatar/6847ba38495b3996e0bdf3a15c015e0c?s=96&d=mm&r=gPaystream Advisors finds that a large percentage of organizations say manual data entry is one of their biggest issues. Companies currently receive invoices in EDI format, paper and email – paper and email (usually a PDF) being the most predominate format.

As a result, a lot of time is spent inputting, processing, and manually transporting supplier invoices. As a company grows, invoice volume puts pressure on staff and resources.

Other Invoice Pain Points

Routing issues, lost or missing invoices, and decentralized invoice receipt are other pain points PayStream uncovered. Exceptions have a tendency to bog down processing time as a result of rigid workflows or missing documents.

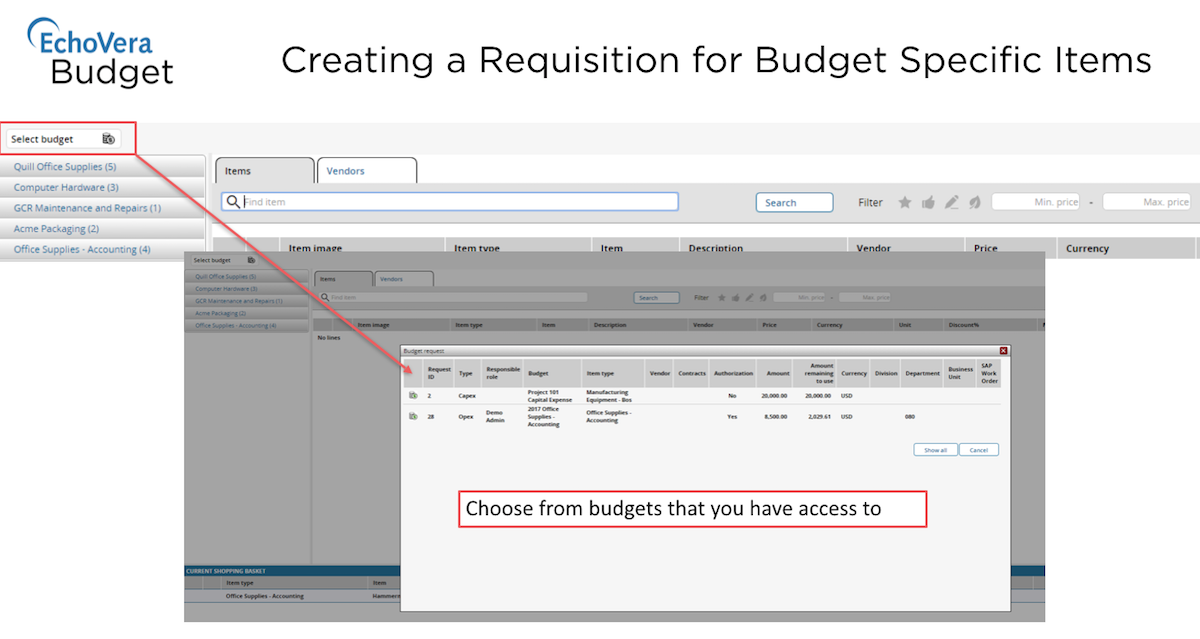

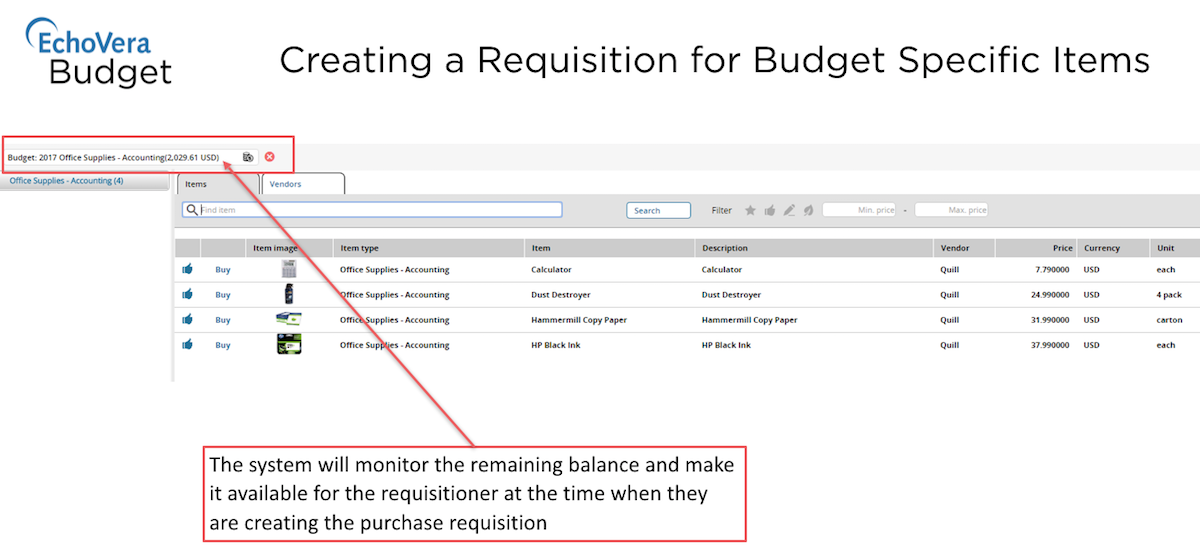

Solving Invoice Processing Issues With Invoice Workflow Automation

The report also reports on how invoice approval workflow automation (IWA) has provided the benefits to companies who have embraced it:

- Lower processing costs

- Improved visibility of liabilities

- Shorter approval cycle times

- More productive employees

Achieving Invoice Workflow Automation Success

The new report also provides advice on how to choose and deploy the right IWA solution for your business. Key deciding factors include:

- types of invoices the organization deals with

- invoice volumes

- ERP integration

- staffing levels

- company growth

To download a copy of the report: PayStream Advisors Invoice Workflow Automation Report click here.