Intacct AP Workflow Gets A Boost

Intacct AP Workflow Gets A Boost https://echovera.ca/wp-content/themes/corpus/images/empty/thumbnail.jpg 150 150 Tim Robertson https://secure.gravatar.com/avatar/b0b77ea14349870d9dc2ba8ce2a0947073217d2f742890353bfc00417e8e4b8a?s=96&d=mm&r=gA new robust Intacct AP workflow incorporates intelligent OCR, authentic automated 3-way matching and audit/reporting functions. It’s a solution that intelligently captures invoice data; matches supplier invoices, purchase orders, and goods receipts; provides a workflow for approvals and coding; and generates reports.

Intelligent OCR – the smart way to capture invoice data

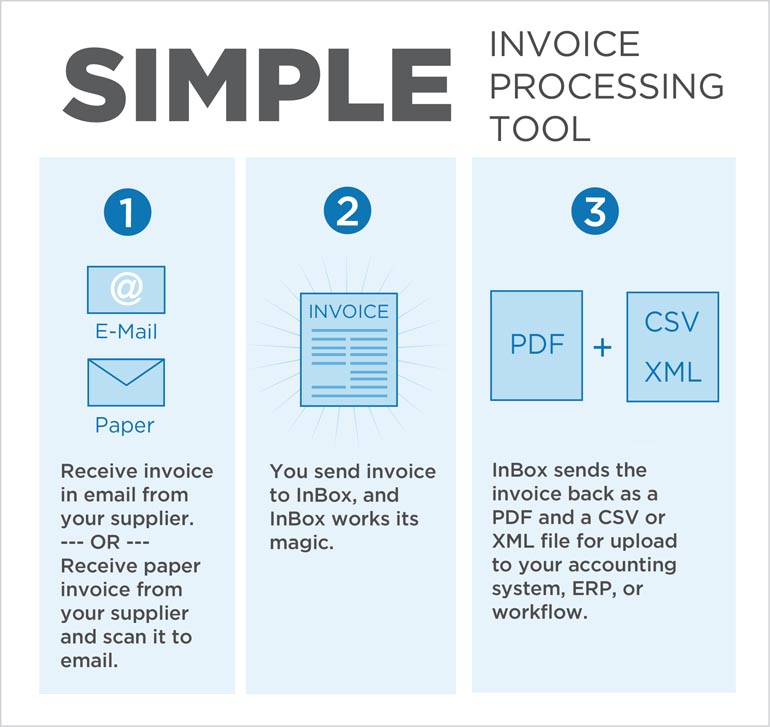

Manually capturing essential fields from paper or emailed invoices can be time consuming. Intelligent data capture solves this problem while at the same time allowing for fewer errors and boosting productivity.

For paper invoices:

Data capture often involves manually keying in data from paper invoices or using Optical Character Recognition (OCR) software to scan the invoices. Conventional OCR often requires manual intervention. Intelligent OCR teaches itself to “read” your different supplier invoices based on their respective layouts, and then intuitively maps the data fields. It uses intelligent tags as identifiers for each data field and stores the information for future reference.

For emailed invoices:

Invoices sent by email are processed automatically by software that maps and stores the data. Virtually all billing applications generate data PDFs and the capture system uses the data layer found in PDF invoices to extract the required information. When invoices are emailed as scanned images, the information is routed to Intelligent OCR.

3 Way Matching

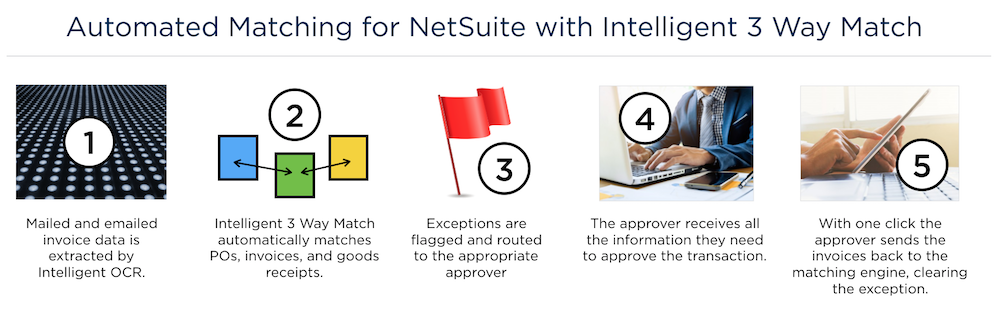

3-way invoice matching refers to the three documents that make up the match process: the supplier’s invoice which has been received and will go into the accounts payable process when approved; the purchase order that initiated the purchase; and the goods receipt or receiving report that shows proof of goods.

An automated 3-way matching process takes much less time and effort than a manual accounts payable workflow. When an invoice matches a purchase order, it inherits the account postings and authorizations from that order and is sent directly to payment. With simple rules, you control what happens to invoices that don’t match a purchase order and which tolerances apply.

Invoices that are matched within your approved tolerances are sent directly to Intacct for recording. Invoices that have values outside of your tolerance values are automatically sent to the appropriate role for review.

Automating the 3-way matching process provides key benefits such as:

- Invoices, POs and goods receipts are matched automatically

- Exceptions are flagged for further review

- Provides a complete audit trail

- Ensures accuracy of the data

Workflow

The AP automation workflow starts with the data capture of either mailed or emailed invoices. Invoices are gathered into a central dashboard. From here they are automatically routed to the appropriate approvers for review and approval. Once approved, invoices are then sent to Intacct.

Audit and Reporting Functions

Our solution, EchoVera ASAP, has online tracking, an audit trail and a searchable archive. In addition to its extensive reporting capabilities, EchoVera ASAP provides you with live status information of all the invoices in the system.

For more information visit EchoVera ASAP – AP Workflow for Intacct.

Defining 3 Way Matching

Defining 3 Way Matching