Accounts Payable

Manual Accounts Payable Processes

Industry research shows us that accounts payable is still essentially a manual process in many organizations. From document receipt, internal routing through to payment processing, AP employees are still manually processing and moving paper throughout the company. This continued dependence on manual labour and paper increases costs, decreases productivity and can add literally days or weeks to the processing time.

Managing change is never easy but more and more organizations have come to realize that it’s time. The benefits of taking that first step to automation clearly outweigh the perceived “pain” associated with moving organizations towards full automation. Just paying bills electronically is not enough however, as that would still leave a mountain of paper to be managed every day: paid invoices, receipts from expenditures, contracts or vendors, etc.

How Does Automated AP Work?

Organizations typically approach AP automation in one of two ways. Through the use of a more generic “document management solution” or by installing a true “procure to pay” (P2P) solution. Document management solutions are generally more generic “toolkits” that lend themselves to a wide variety of processes while P2P solutions focus solely on your entire purchase to pay life cycle.

Essential to both approaches to AP automation is “workflow”. A comprehensive workflow component enhances internal communication and speeds up the AP process. Workflow automates the invoice payment approval process including the actual movement of invoices throughout your organization. Using both time and event-based triggers, workflow automatically routes documents and reminders from person to person, or from step to step.

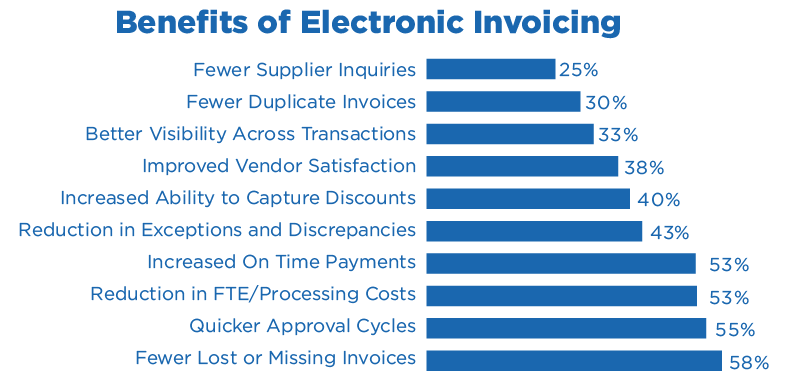

E-Invoicing Adoption Survey Report 2010

@2010 Paystream Advisors, Inc.

Automate the Accounts Payable Process: EchoVera AP Automation

Contact us for more information on Accounts Payable Automation.